Not always and doesnt eliminate it. Given that the portfolio beta is 18 Theresa understands that her portfolio returns.

Solved Which One Of These Represents Systematic Risk O Chegg Com

A Lower car sales announced by the auto sector in general b An increase in the price of steel used in automobiles c Lower interest rates leading to an increase in the stock market in general d The Ford Motor.

. The security market line is a linear function that is graphed by plotting data points based on the relationship between the. A Discovery of a major gas field B Decrease in textile imports C Increase in agricultural exports D Decrease in gross domestic product E Decrease in management bonuses for banking executives Answer. In contrast Unsystematic risk is bifurcated into two broad categories namely Business Risk and Financial Risk Business Risk And Financial Risk Business risk affects the value of a company via loss of market share or by new entrants who destroy our business.

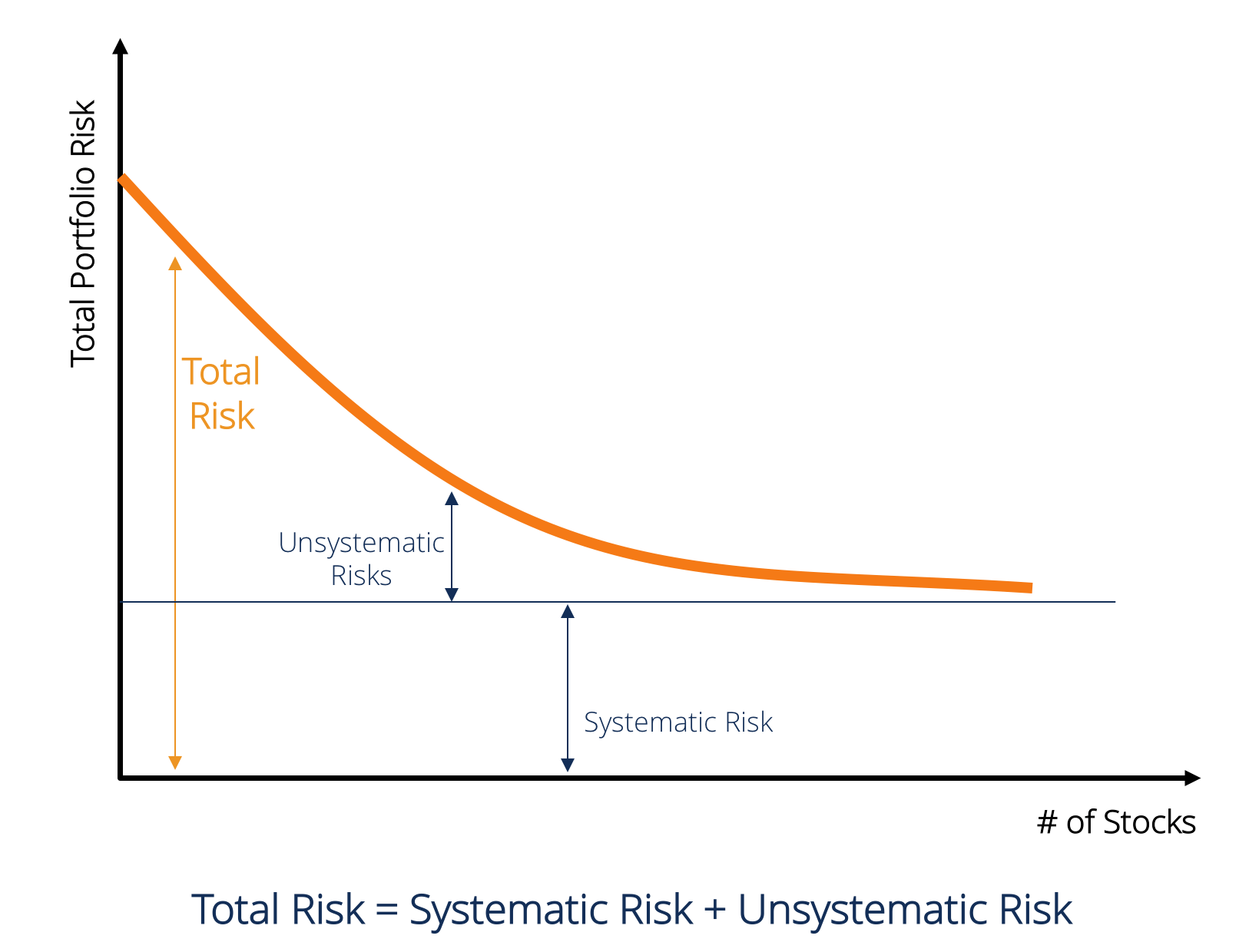

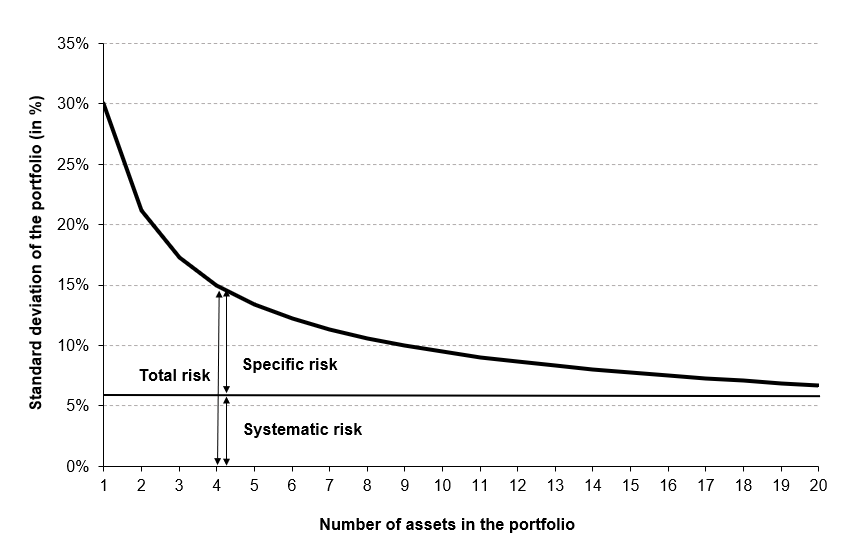

These ratios are concerned with the risk and return. 1 unique risk firm risk market risk asset-specific risk diversifiable risk 2. Different connotation of risk can be shown as under.

A stock market correction would wipe out wealth created by fund managers and. Systematic risk is also sometimes referred as market risk or un-diversifiable risk. Government reducingincreasing interest rates which would affect the valuation of Securities.

No related questions found Welcome to Sciemce where you can ask questions and receive answers from other members of the community. Systematic Risk and Unsystematic Risk. Such risks are called systematic risks.

The uncertainty inherent to the market as a whole and which cannot be diversified. Westfield closing a shopping mall due to COVID. Systematic risk is the risk inherent to the entire market attributable to a mix of factors including economic socio-political and market-related events.

Personnel changes are a firm-specific event that is a component of nonsystematic risk. Check all that apply Allows you increase your return on equity magnifying positive or negative returns by borrowing money. Expected return and beta.

8 The risk - free rate is 37 percent and the expected return on the market is 123 percent. Systematic risk is defined as Any risk that affects a large number of assets Unsystematic risk can be defined by all of the following except Market Risk asset specific risk diversifiable risk and unique risk Which term best refers to the practice of investing in a variety of diverse assets as a means of reducing risk. Increases your default risk by magnifying the standard deviation risk of your portfolio.

Theresa holds a diversified portfolio constructed of 500 shares of a technology company 500 corporate bonds and 500 municipal bonds. Up to 25 cash back Which one of the following terms is another name for systematic risk. In contrast to the Sharpe Ratio which adjusts return with the standard deviation of the portfolio the Treynor Ratio uses the Portfolio Beta which is a measure of systematic risk.

Hence market risk is the tendency of security prices to move together. Stock B has a beta of 86 and an expected return of 114 percent. Theresa worries about the recent cut in the interest rates and she wants to know the systematic risk of the stocks that she holds in the portfolio.

Total risk General risk Specific risk Systematic risk Non-systematic risk. While this risk type affects a wide range of securities. A and D are false.

Elon Musk smoking weed on live TV. Systematic and Unsystematic Systematic and unsystematic risk 11-03 Define the systematic. Qantas laying off 20000 staff.

22 Which one of these is the best example of systematic risk. The tendency of investors to follow the direction of the market. A Major layoff by a regional manufacturer of power boats B Increase in consumption created by a reduction in personal tax rates C Surprise firing of a firms chief financial officer.

The Treynor Ratio is a portfolio performance measure that adjusts for systematic risk. A B and C are true. Unsystematic risk is the risk that occurs because of a companys operation while systematic risks are those occurring in the market that cannot be avoided by diversification of stocks.

5 Political Instability and Flight of Capital Flight of Capital Political instability is a major risk faced by companies in many countries. Rigorous testing and fixing of defects found can help reduce the risk of problems occurring in an operational environment. Examples of systematic risk that would affect the whole economy as described under the various types are illustrated in the example below.

-Impossible to find all failures. Market Risk Market risk is caused by the herd mentality of investors ie. Quiz Grade 2.

Rigorous testing is sometimes used to prove that all failures have been found. Which one of these represents systematic risk. This risk is nonexistent in countries with stable governments There are countries in the world that are perennially in a state of political instability.

The others are all sources of systematic risk. You own a stock which is expected to return 14 percent in a booming economy and. Stock A has a beta of 11 and an expected return of 131 percent.

As explained by Investopedia recession wars and interest rate represent the sources for systematic risk for they affect the complete market and are unavoidable through diversification. Systematic risk also known as undiversifiable risk volatility or market risk affects the overall market not just a particular stock or. The amount of systematic risk present in a particular risky asset relative to that in an average risky asset is measured by the.

The systematic risk known as non-diversifiable or market risk is directly associated with overall movements in the general market or economy. Business Finance QA Library Which one of the following best describes systematic risk in owning the common stock of the Ford Motor Automobile company. Systematic Risk is divided into 3 categories ie Interest Rate Risk Purchasing Power risk and Market risk.

It can reduce risk. Which one of these represents systematic risk. A rise in consumer confidence.

Systematic risk includes market risk interest rate risk purchasing power risk and exchange rate risk.

Systematic Risk Learn How To Identify And Calculate Systematic Risk

Systematic Risk And Specific Risk Simtrade Blogsimtrade Blog

/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)

0 Comments